Our Firm

Our formula for success comes from our disciplined investment process bolstered by our firm’s breadth of operational experience. We seek to identify opportunities where asset dislocation, property distress, and market fundamentals allow us to apply our unique skillsets to generate strong risk-adjusted returns.

Together, across our firm, our mission is to drive long-term value for our investors through private real estate. We invest alongside our clients on equal terms and conditions.

Sector Strategy & Approach

Bluefin Capital dedicates a significant amount of time, energy, and resources towards developing a strategy aimed at offering investors distinctive opportunities in the real estate sector. This strategy involves allocating capital throughout the entirety of the real estate cycle with careful foresight and consideration. The investment objective focuses on (i) achieving durable current income while maximizing risk adjusted long-term total returns (ii) generating an alternative investment vehicle to lower correlation to equity markets (iii) Leveraging tax efficiencies specifically designed for real estate.

Spectrum With Our Investment Platform

Our firm specializes in creating value through the acquisition and repositioning of commercial assets within secondary markets. Our broad experience and detailed due diligence process allow us to execute on precise business plans focused on physical improvements, site expansions, and operational efficiencies, resulting in significant value creation for our investors.

Our core plus opportunities focus on stabilized assets in markets with strong fundamental economic drivers and positive growth trends. Our team is able to exploit market and operational inefficiencies to unlock additional value for our investors with limited downside risk.

Our firm gives investors the unique opportunity to diversify into a debt product securitized by our stable, commercial real estate assets. We are proud to offer our investors access to the entire project capital stack to meet their individual risk profiles.

Our firm is active in the ground-up development space. Our team seeks opportunities in supply-constrained markets with strong underlying demographics coupled by favorable rental rates. We deliberately search for properties in strategic locations that out-position the competition. Upon completion of development, our management team executes our stabilization strategy to ensure a successful lease up.

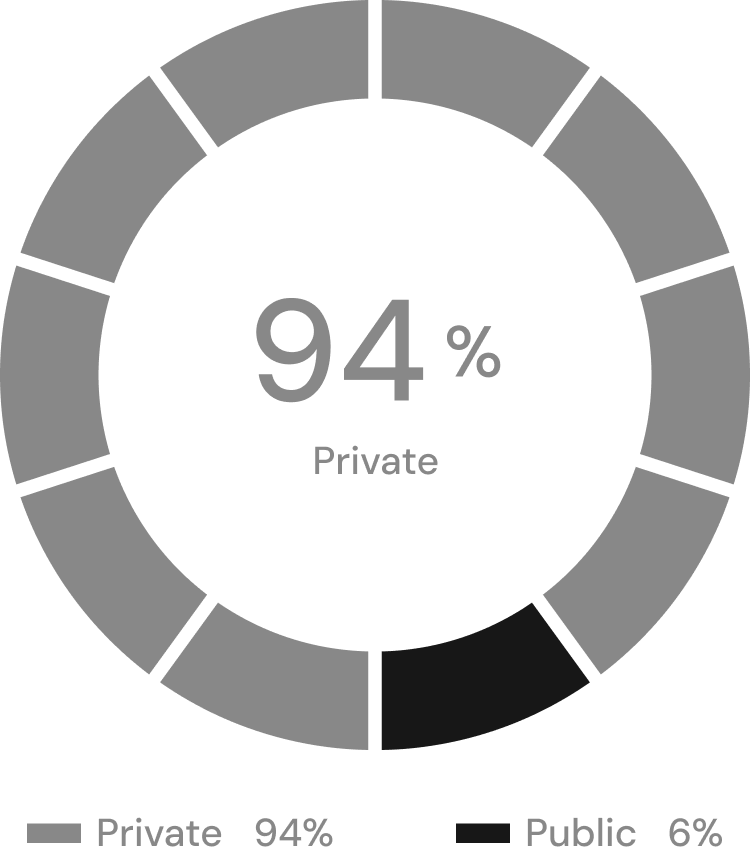

Why Private Real Estate?

diversification

substantially lower volatility

Real Estate is the Third Largest Asset Class

Unlike equities or fixed income, real estate is both income-oriented and capital appreciation-oriented

Debt Outstanding

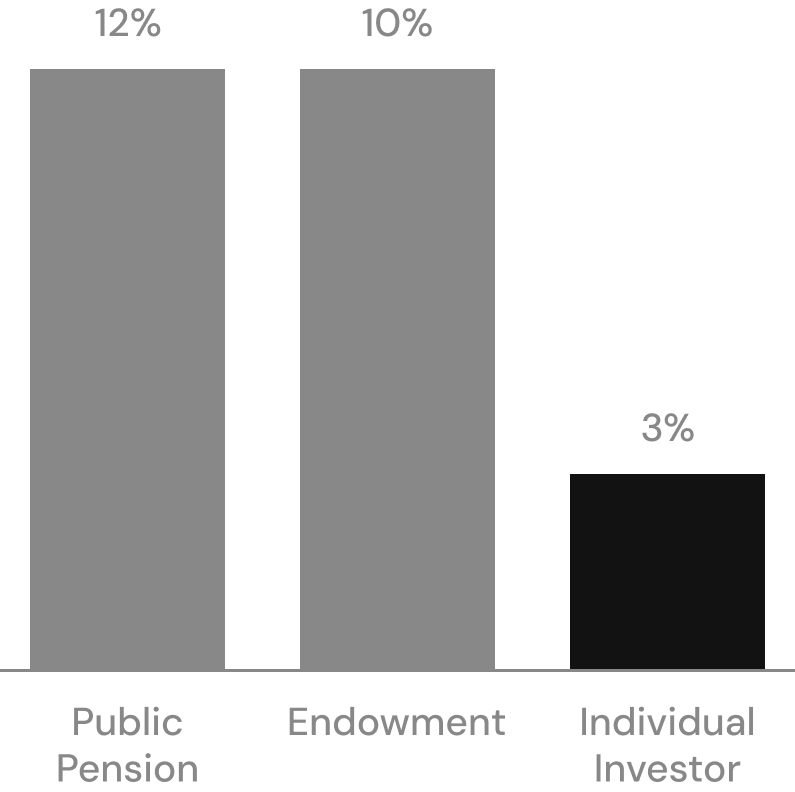

Historically, private real estate has delivered competitive long-term total returns and favorable risk-adjusted returns relative to equities and bonds. Over the past two decades, average income returns in U.S. private real estate have outperformed those of U.S. bonds and equities.

Inflation can erode the purchasing power of income from stock dividends or fixed income. However, income generated by private real estate is linked to rents, which generally rise when inflation goes up. Real estate income growth has historically kept pace with inflation.

Our direct ownership structure offers our clients attractive tax benefits such as depreciation deductions, long-term capital gains tax treatment, and deferred taxes via incentive programs.